What I Learned Today

By Jake Bernstein

Monday 18 July 2011 1:43 PM PT

© 2011 Jake Bernstein

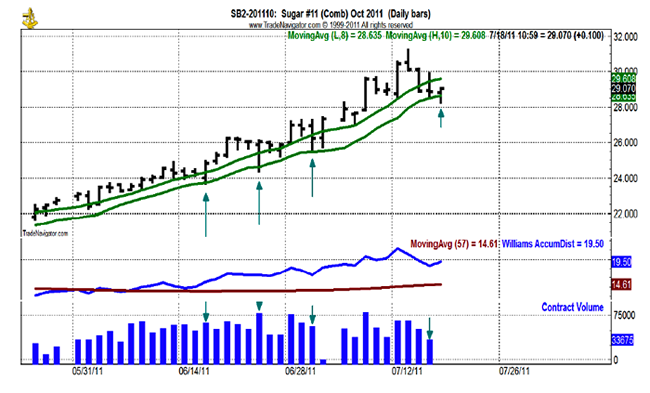

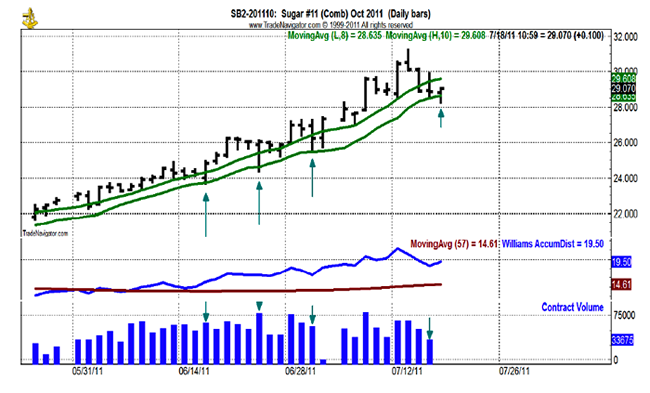

Here it is Monday, the first day of my new service to you and I’ve already learned or re-learned a lesson early in the day and I share it with you. Although it may be redundant what I have for you today is real and it’s valid. The MA channel 10 high and 8 low has been an amazingly accurate indicator for swing trading the channel. As of today sugar has once again hit the bottom of the MAC and turned around to the upside for yet another profitable trade. But as you know there is always a tendency to say “this time it will be different”. And this time (today) there was a good reason to hide behind that explanation. Why? Because contrary to the last few times prices rallied from the MAC low very quickly (see arrows on the chart). THIS TIME the rally was not immediate. In other words it took a few hours. Also in the “looking for excuses” department the volume today was much lower than the last three times (compare current day arrow to the last three). And as long as we’re looking for excuses we might as well say that today the trading range was also smaller than before so it’s also not a good trade. THESE ARE ALL EXCUSES THAT HAVE NOTHING TO DO WITH THE ORIGINAL METHOD OR PROCEDURES…The bottom line is that again the trade was profitable.

LESSON LEARNED: You can find all sorts of excuses to make a trade or to not make a trade if you’re looking for excuses. In other words, given enough statistics you can prove anything. Don’t do that or you will not be happy and you will learn a very bad habit!

|

What I Learned Today

By Jake Bernstein

Tuesday 19 July 2011 1:52 PM PT

© 2011 Jake Bernstein

Shut out the noise! Today was just another one of those days where a trader needs to learn how to put on earmuffs and stop listening to the superfluous noise, opinions, forecasts, and recommendations touted by "experts" in the media. We need to constantly learn and relearn the fact that if we have confidence in the game we are playing and we must be crystal clear on the rules if we have seen the rules work repeatedly. We need to play the game by our own rules and learn to ignore what the loudmouths are saying. As usual Jim Cramer hits the airwaves on CNBC today and in own abrasive style tells us that we need to buy gold. As always the man is confident, emphatic, self-assured and typically obnoxious. He tells us we need to buy gold. He tells us we need to buy gold now on the correction. Gold is down a few dollars at the time and then proceeds to plunge about $20. I'm looking at my moving average channel and I want to buy gold some 30 or $40 lower. So I'm waiting. Pity the poor newcomer to futures trading who listens to a trade recommendation without a stop, without an entry price, without an idea of risk, and without any specifics whatsoever other than "you need to own gold and you need to buy on the correction that is happening right now".

This lesson of doing your own work and remaining true to your work is one that we will learn time and time again and even then we will have to learn it repeatedly. We will always be vulnerable to opinions, news, prognostications, and recommendations given by those for whom we have even the slightest bit of respect given that they may have been right in the past. I always like to look at my own track record of recommendations and ask myself the question "how well have my forecasts worked?" Specifically in case of gold I remind myself that I have been long gold for over eight years now. I remind myself that several years ago when I wrote articles for Jim Cramer's website I recommended gold many times, even before Mr. Cramer imagined that one day he might recommend gold. At that time gold wasn't even in his vocabulary and today he's the gold expert.

LESSON LEARNED: You must play your own game, by your own rules, in your own time with your own triggers with the appropriate degree of risk which will be a testament to your belief in self, to your confidence, to your skill as a trader. Sometimes you will be wrong but oh how well you will do when you're right and how strongly your confidence will grow. And with your confidence will also grow your profits. And with your profits will grow more confidence. And with more confidence will grow more profits. And soon you may also be that obnoxious person on CNBC but you won't have to be because you will quietly be a massing your own fortune without the need to shoot your mouth off with nonspecific generalizations about what to do and in what markets.

What I Learned Today

By Jake Bernstein

Wednesday 20 July 2011 5:37 PM PT

© 2011 Jake Bernstein

You can’t tell the markets what to do. No matter how much you want a trade to work or to reach

a given entry point or target the market has a direction and a mind of its own.

Some common questions I get from traders are:

• The market won’t hit my target. What should I do?

• Why is it taking so long for a buy signal to develop?

• I’m so frustrated – the trade missed my target by one tick – now what?

• The seasonal says we’re supposed to top but it’s not happening – why not?

• Why does the market keep picking my stops?

While each of these questions has a solution, they all represent one thing. They mean that we are stymied or angered or frustrated because things are not going exactly as we had planned. We must remember that the trading game is not totally predictable and that all markets, all trades and all outcomes have a certain amount of built in random behavior. Yes, there are things we can do up front in order to capture the predictable aspects of market moves and there are procedures we can implement in order to deal with situations such as those above when they arise.

The best response is to “deal with it”. The worst response is to let it anger or frustrate you. Accept the fact that most trades will not be perfect. But if we do our homework within the structure we have established (i.e. setup, trigger and follow through) and within our methods then we will come out ahead in the long run.

So if you bought the last MAC low in October sugar and your target has not yet been hit the response is to either take the current profit and run, or to be patient, or to see where most sell orders are on your depth of market data and exit before the majority of orders.

LESSON LEARNED: Give each trade a chance to do what it’s supposed to do. Yes, you can manage the trades more closely but you need to do so according to a set of standards, rules and/or procedures. The market will not cooperate every time and you must respond as a professional with consistent and clear procedures that are rule based as opposed to emotionally based

What I Learned Today

By Jake Bernstein

Thursday 21 July 2011 7:14 PM PT

© 2011 Jake Bernstein

The Sweet Taste of Success!

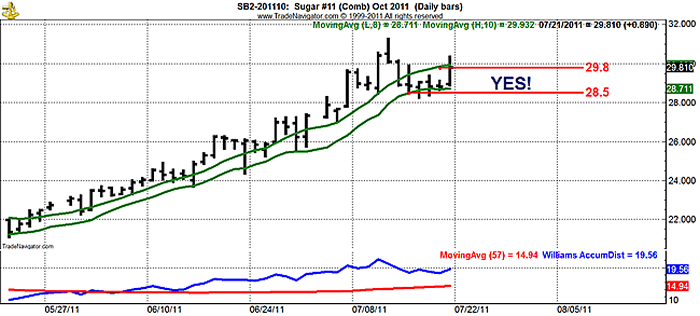

Yesterday I ended my commentary with the following statement:

“Accept the fact that most trades will not be perfect. But if we do our homework within the structure we have established (i.e. setup, trigger and follow through) and within our methods then we will come out ahead in the long run. So if you bought the last MAC low in October sugar and your target has not yet been hit the response is to either take the current profit and run, or to be patient, or to see where most sell orders are on your depth of market data and exit before the majority of orders”. I made a few strong statements about the fact that markets are not here to please us and that they don’t always reach targets. My comment about the sugar market was very apropos because many of the questions I received yesterday were about the moving average channel trade in sugar. As the swing trade rule goes, we were to buy the bottom of the moving average channel in sugar as shown in chart form below and exit at the top of the channel for swing trade. Apparently traders were spoiled by the fact that the last few swing trades in sugar responded almost immediately and hit their target. This one made us wait. And today our patience was sweetly and handsomely rewarded as the sugar market not only shot up to hit its target but exceeded the target significantly. Trading is not only about picking the right trades but also about being patient enough to give the market and your method and opportunity to work. I've said it before and I'll say it again "micro managing trades will not bring you success". If you must micromanage a trade then do so with a specific procedure in mind and make sure you use the same procedure every time.

LESSON LEARNED: my rules are good, my methods are good, and although not perfect they work.

Give them time!

What I Learned Today

By Jake Bernstein

Friday 22 July 2011 8:43 PM PT

© 2011 Jake Bernstein

The Many Faces of Self Doubt

Every trader can become the victim of insecurity. Different traders have different insecurities. Of all the issues that can keep a trader from doing what they're supposed to do insecurity or self-doubt is perhaps the most potentially limiting and or destructive of all emotions. Self-doubt is always there to undermine your trading by causing you to either avoid a trade that you should take or to get out of a trade too soon or too late. Despite all the research and trading that one does the fear of taking a loss, or feeling stupid or feeling like a failure is always there lurking under the surface trying to make you fail. I am certainly not immune from self-doubt. In fact it is always attempting to undermine me if I allow it to do so. When I look back at profits I should have made, losses I should not have taken, and trades which I got out of too soon or too late due to self-doubt I suffer from even more self-doubt. But I save myself nowadays by using a simple formula. I go into every trade knowing that the research and the results backing up that research have been valid.

I go into every trade knowing that some excellent profits have been made in the past by following the rules. In so doing I know that there is only one variable that is relevant once there is a signal to enter. And that variable is the risk. If I can't afford the risk and if the risk cannot be mitigated by a smaller contract or smaller position then that trade is not for me. However, if the risk is acceptable then no other extraneous variable, whether political, fundamental, emotional, or technical can or should enter into the decision-making process.

The trade must go on. The show must go on. I close my eyes and jump off the cliff. It should also be noted that I must not console myself or justify a trade based on a positive expectation resulting from external variables. In other words I must not say to myself "the trade will definitely work this time because the fundamentals supported". A trade is a trade. A method or system is a method and system. If the system is good. If the risk is correct. And if I fool myself immediately upon making the trade that the money has been lost; that the trade has been stopped out; and that I have failed, then the worst is over and it can only get better from there.

LESSON LEARNED: my lesson today was learned because I had self-doubt about the Friday Monday gold trade. Before I stopped myself from thinking the wrong way I started telling myself that the trade wouldn't work because gold was already "too high". I stopped myself quickly because I knew my thinking was dreadfully wrong. And because I follow my rules and did not get in to self-doubt but rather lived in reality I was rewarded with a successful outcome. |